Buying your next property.

Are you buying your next family home?

At WeNeedFinance, we understand that finding the right mortgage can be a daunting task, especially for home buyers looking for their next family home. That's why we're here to simplify the process and help you secure the financing you need to make your dream of homeownership a reality.

Our Expertise in Home Financing

As a leading mortgage broker firm, WeNeedFinance brings extensive expertise and industry knowledge to the table. Our team of experienced professionals is dedicated to guiding you through every step of the mortgage process, ensuring that you make informed decisions that align with your financial goals.

Determining Your Borrowing Capacity

One of the key services we offer is helping you determine your borrowing capacity. We take into account various factors, including your income, expenses, and credit history, to calculate the maximum loan amount you can afford. This crucial information allows you to set realistic expectations and narrow down your property search accordingly.

Applying for Pre-Approval

Once we have established your borrowing capacity, our team will assist you in obtaining pre-approval. Pre-approval gives you a clear idea of how much you can borrow, which strengthens your negotiating power when making an offer on a property. With our expertise, we streamline the pre-approval process, ensuring a smooth and efficient experience for you.

Why Choose WeNeedFinance?

1. Personalised Approach

At WeNeedFinance, we recognise that every home buyer is unique. We take the time to understand your specific needs and financial circumstances, tailoring our services to meet your requirements.

2. Extensive Lender Network

As a mortgage broker, we have access to an extensive network of lenders, including major banks, credit unions, and alternative lending institutions. This allows us to explore a wide range of loan options and find the best terms and rates that suit your individual situation.

3. Expert Guidance

Our team of mortgage professionals possesses in-depth knowledge of the industry and keeps up-to-date with the latest market trends. We leverage this expertise to guide you through the complexities of the mortgage process, answering your questions and addressing any concerns along the way.

4. Efficient and Transparent Service

We pride ourselves on providing efficient and transparent service. We keep you informed at every stage of the process, ensuring that you have a clear understanding of the steps involved and the progress being made.

Take the First Step Towards Homeownership

If you're ready to embark on your homebuying journey, let WeNeedFinance be your trusted partner. We'll help you determine your borrowing capacity, assist with pre-approval, and provide expert guidance throughout the entire mortgage process. Contact us today to get started and let us help you secure the financing you need for your dream home.

Book your free consultation today.

How we will work together.

-

We will send you an online fact find to collect some information about your objectives, your income, assets and other financial information. We will then use this information to workout your initial borrowing capacity.

-

We’ll talk about your goals, present some options and an early recommendation. A list of support documents required will be sent to you.

-

We’ll search the market and ensure our recommendation is the most competitive solution for you, and the lender policies best fit your needs.

-

You’ll be presented with a Personalised Game Plan with tailored solutions and recommendations to meet your goals and objectives.

-

We’ll work with the lender you choose to package, sign and lodge your documents - and do the legwork to get you approved.

-

Congratulations! This is what we live for. We’ll let you know that everything has gone smoothly with your loan so you can pop the champagne.

-

This is the moment when the lender releases the money to you. We’ll be there for you during the settlement process to let you know everything has gone through.

-

This is just the beginning of our partnership. It’s our ambition to help your financial future thrive. We’ll be in regular contact with you to check in on your situation and make sure your loan continues to work hard for you, your changing situation and goals.

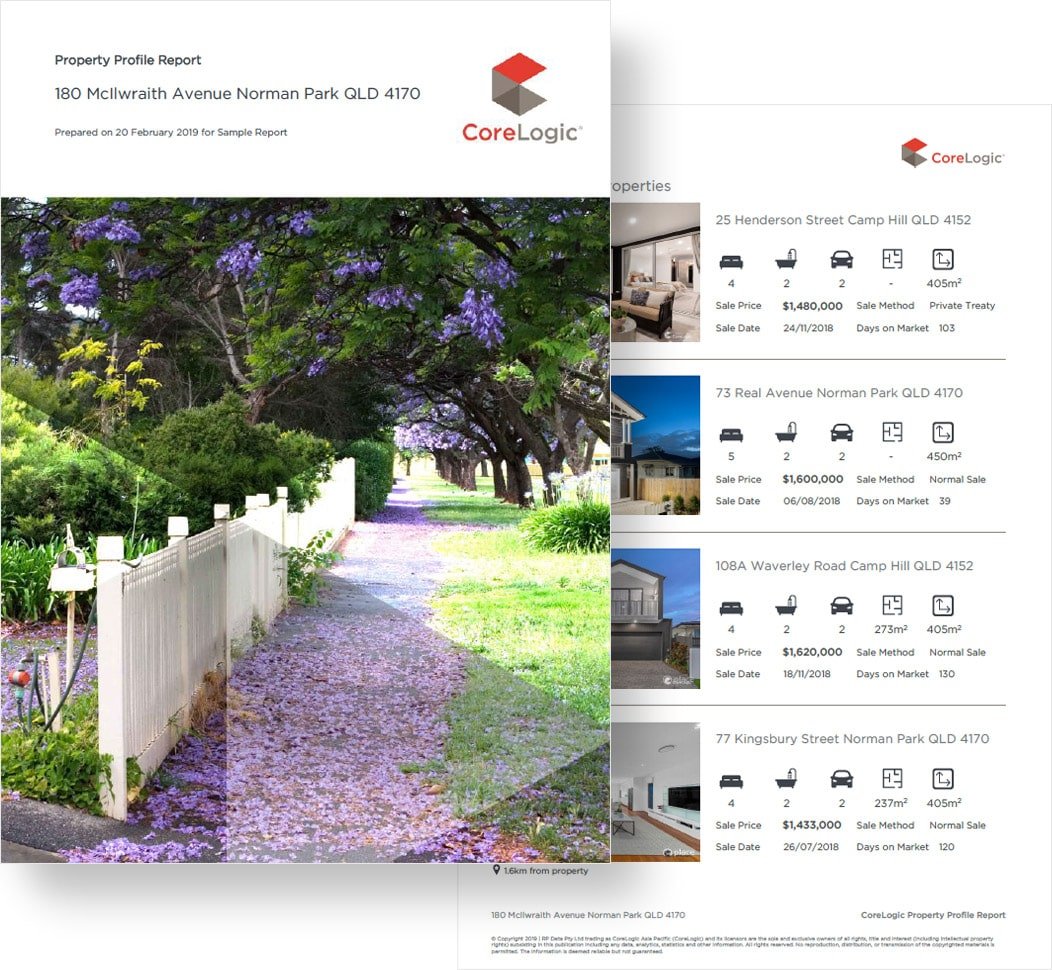

We can send you a free property report which contains useful market insight and an estimated market value.

Going to auction this weekend?