Helping you find the right home loan.

Choosing between home loan products and lenders can be time-consuming and really confusing if you don’t get expert advice.

Whether you’re getting approved for your first property, building your dream home, or purchasing an investment property, our experienced team can help you find a loan that matches your financial situation.

Home buyers

Looking at buying your family home? We can help you assess your borrowing capacity and workout your options.

Wether you are upgrading, building, or bridging, we have the experience to help you with your next home purchase.

First Home buyers

When purchasing your first property, don’t let yourself be overwhelmed.

From making the decision to purchase, to finding the right loan and researching different grants or schemes available. We will guide you through the whole process.

Property Investors

Before you start planning, it is important to know your true borrowing capacity and what the repayments will look like.

We work with you or your Financial Planner and Accountant to make sure that you make the best informed decision.

Refinancing

We offer refinancing options to our clients who need some help with their cash flow.

Reduce your interest rate,

Consolidate other debts (credit cards etc.),

Cash-out for your home renovations.

Expat lending

Are you an Australian expat or Permanent Resident living and working overseas?

We can help you with your next property purchase in Australia or with the refinance of your current property.

Ethical Banking

Do you need a bank that is responsible and sustainable?

If this is important to you, we may have the right option for your future home loan. Contact us for more details and we can recommend a lender offering a clean money alternative.

Car Finance

Are you looking at buying a new car? Contact us before you head to the dealer so we can organise a pre-approval for you.

We also offer a range of asset finance solutions for businesses.

How we will work together.

-

We will send you an online fact find to collect some information about your objectives, your income, assets and other financial information. We will then use this information to workout your initial borrowing capacity.

-

We’ll talk about your goals, present some options and an early recommendation. A list of support documents required will be sent to you.

-

We’ll search the market and ensure our recommendation is the most competitive solution for you, and the lender policies best fit your needs.

-

You’ll be presented with a Personalised Game Plan with tailored solutions and recommendations to meet your goals and objectives.

-

We’ll work with the lender you choose to package, sign and lodge your documents - and do the legwork to get you approved.

-

Congratulations! This is what we live for. We’ll let you know that everything has gone smoothly with your loan so you can pop the champagne.

-

This is the moment when the lender releases the money to you. We’ll be there for you during the settlement process to let you know everything has gone through.

-

This is just the beginning of our partnership. It’s our ambition to help your financial future thrive. We’ll be in regular contact with you to check in on your situation and make sure your loan continues to work hard for you, your changing situation and goals.

We will workout your borrowing capacity and find the right lender policy that suits your specific needs.

Our priority is to make sure that you receive the right advice from the start so your lender approves your loan and you settle on time.

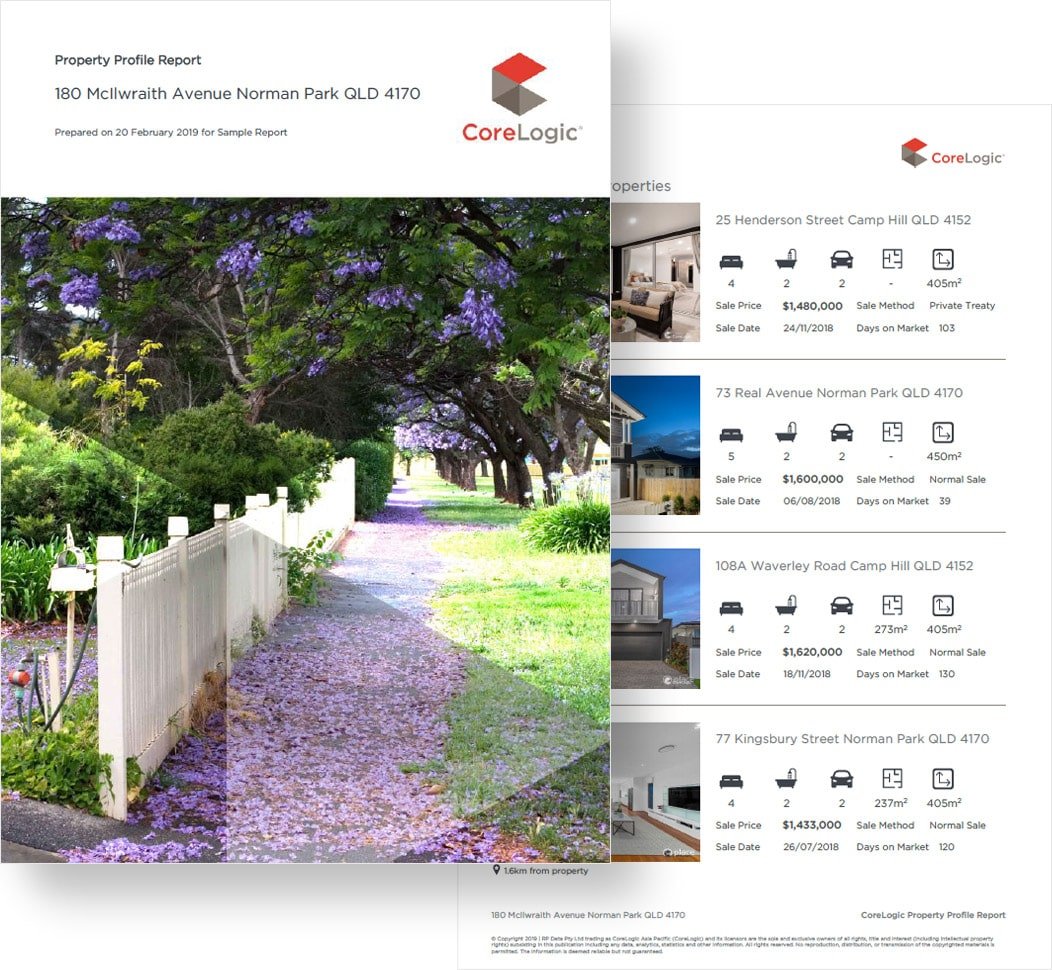

We can send you a free property report which contains useful market insight and an estimated market value.

Going to auction this weekend?

FAQs

How long will my pre-approval last?

A pre-approval is usually issued for 90 days and we can extend it for another 90 days by providing updated payslips and other documents required by the lender.

Which banks do you have access to?

We have access to 60+ lenders, this includes all the big banks and most small lenders in Australia. Contact us for more details about our preferred lenders and to find out about the lending policies that would suit your finance needs.

Are there any fees for your services?

We don’t charge any fees for your application. We receive a commission based on the balance of your loan from the lender at settlement and as long as you keep your loan for 24 months.

Do you offer Zoom or home consultations?

We try to keep it simple and convenient for everyone. If you are not able to come to our office in St Kilda, we can organise an online meeting via zoom or we can visit you at your preferred location during or after business hours. Contact us for more details.

Will you help with my settlement?

Yes, we will. We help our clients all the way to settlement and liaise with your conveyancer to make sure you are constantly updated and settle on time. We will also help you review your home loan rate and features for the years to come at no cost to you.

Can you offer the best rate on the market?

We have your best interest at heart and will always try to offer you the most competitive rate but we will also consider lending policies and your specific requirements when finalising our recommendations.