Refinancing your home loan

Thinking about refinancing?

Are you looking for ways to optimise your financial situation? Consider the benefits of refinancing. Refinancing is a powerful financial tool that allows homeowners to restructure their existing mortgage, potentially lowering monthly payments, reducing interest rates, or accessing additional funds.

At WeNeedFinance, our team of experienced mortgage professionals can guide you through the refinancing process with ease. We understand that every individual's financial needs are unique, which is why we offer personalized solutions tailored to your specific goals.

Refinancing can provide several advantages, including:

1. Lower Interest Rates: If interest rates have dropped since you obtained your original mortgage, refinancing can allow you to secure a new loan at a lower rate. This can lead to substantial savings over the life of your mortgage.

2. Monthly Payment Reduction: Refinancing can help lower your monthly mortgage payment by extending the loan term or obtaining a lower interest rate. This can free up additional funds for other financial goals or provide much-needed breathing room in your budget.

3. Debt Consolidation: If you have high-interest debts such as credit cards or personal loans, refinancing can allow you to consolidate these debts into your mortgage. By combining multiple payments into a single, more manageable one, you can simplify your finances and potentially reduce your overall interest costs.

4. Access to Home Equity: Refinancing can enable you to tap into the equity you have built in your home. Whether you want to fund home improvements, invest in education, or consolidate debts, this can be a valuable source of funds.

At WeNeedFinance, we pride ourselves on our commitment to providing exceptional service and finding the best refinancing solutions for our clients. Our team will walk you through the entire process, from assessing your financial needs to securing the most favourable terms for your refinanced mortgage.

Why Choose WeNeedFinance?

1. Personalised Approach

At WeNeedFinance, we recognise that every home buyer is unique. We take the time to understand your specific needs and financial circumstances, tailoring our services to meet your requirements.

2. Extensive Lender Network

As a mortgage broker, we have access to an extensive network of lenders, including major banks, credit unions, and alternative lending institutions. This allows us to explore a wide range of loan options and find the best terms and rates that suit your individual situation.

3. Expert Guidance

Our team of mortgage professionals possesses in-depth knowledge of the industry and keeps up-to-date with the latest market trends. We leverage this expertise to guide you through the complexities of the mortgage process, answering your questions and addressing any concerns along the way.

4. Efficient and Transparent Service

We pride ourselves on providing efficient and transparent service. We keep you informed at every stage of the process, ensuring that you have a clear understanding of the steps involved and the progress being made.

Book your free consultation today.

Get in touch with our friendly team at WeNeedFinance today. We'll be delighted to assist you in turning your dream of owning a home into a reality.

How we will work together.

-

We will send you an online fact find to collect some information about your objectives, your income, assets and other financial information. We will then use this information to workout your initial borrowing capacity.

-

We’ll talk about your goals, present some options and an early recommendation. A list of support documents required will be sent to you.

-

We’ll search the market and ensure our recommendation is the most competitive solution for you, and the lender policies best fit your needs.

-

You’ll be presented with a Personalised Game Plan with tailored solutions and recommendations to meet your goals and objectives.

-

We’ll work with the lender you choose to package, sign and lodge your documents - and do the legwork to get you approved.

-

Congratulations! This is what we live for. We’ll let you know that everything has gone smoothly with your loan so you can pop the champagne.

-

This is the moment when the lender releases the money to you. We’ll be there for you during the settlement process to let you know everything has gone through.

-

This is just the beginning of our partnership. It’s our ambition to help your financial future thrive. We’ll be in regular contact with you to check in on your situation and make sure your loan continues to work hard for you, your changing situation and goals.

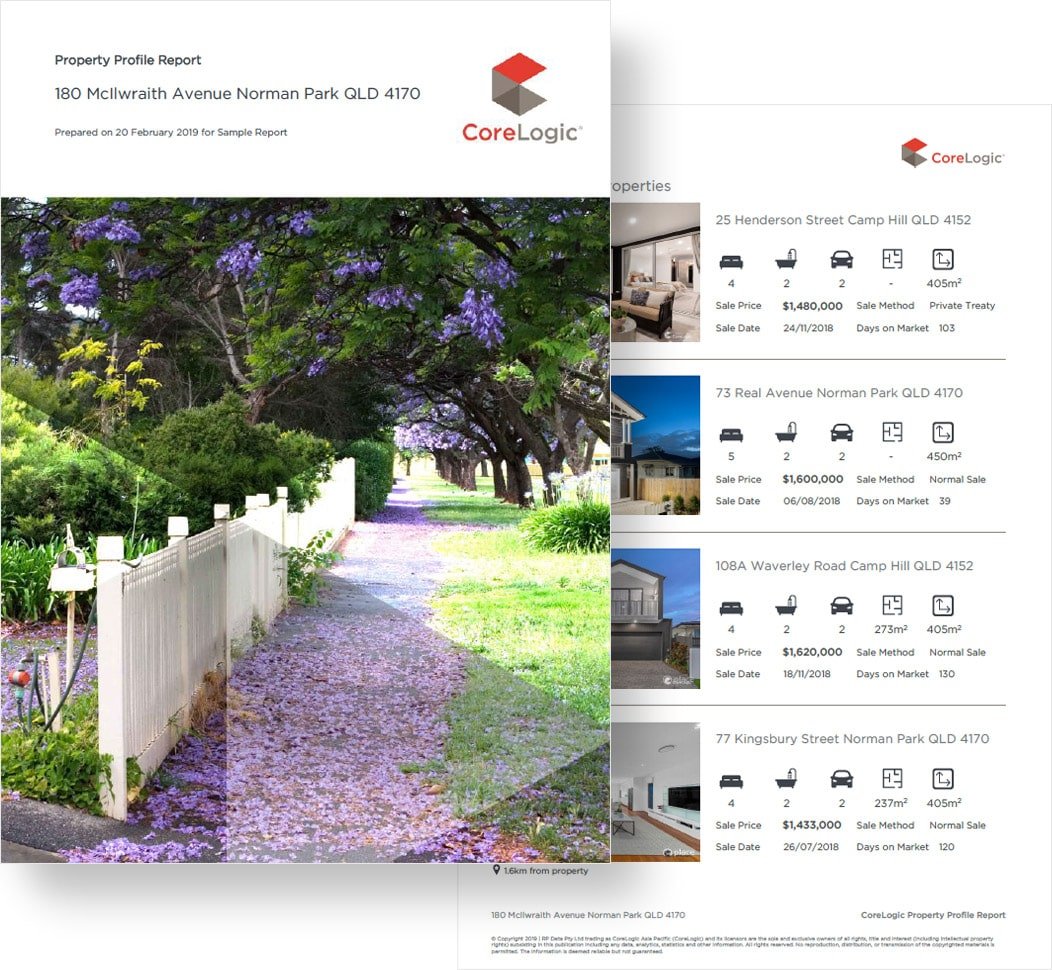

We can send you a free property report which contains useful market insight and an estimated market value.

Going to auction this weekend?